GLP Tail Risk

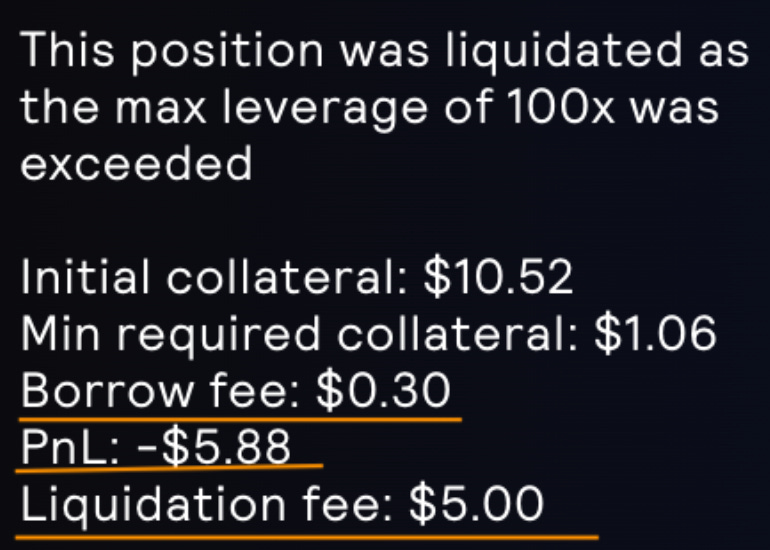

The market is falling again. If traders betted correctly and made massive gains when market falls, GLP holders would get rekted. This is known as the GLP tail risk since it’s considered a low-probability event. And I’ll try to assess it in this article. But first, let me explain the relationship between traders and GLP holders. The best way to do it is through an example, so I placed a trade and got myself liquidated. The screenshot below shows the details. I paid 30c borrow fee and $5 liquidation fee. My PnL was -$5.88. The 30c borrow fee and $5 liquidation fee and my $5.88 loss were to be paid out to GLP holders and GMX stakers as ETH/AVAX rewards.

If you are a trader, you probably only care about your effective PnL after subtracting borrow and liquidation fees. In my example, that’s -$11.18. But if you are a GLP provider, you will also want to care about traders’ PnL before borrow and liquidation fees because it affects GLP price1. So I analyzed traders’ daily PnL data, both before and after borrow and liquidation fees, of the past 353 days. The method I used is called the sampling distribution of the sample mean. If you don’t know what it is, I suggest you look it up because it’s a fundamental knowledge point in statistics. Khan Academy has some good videos on it.

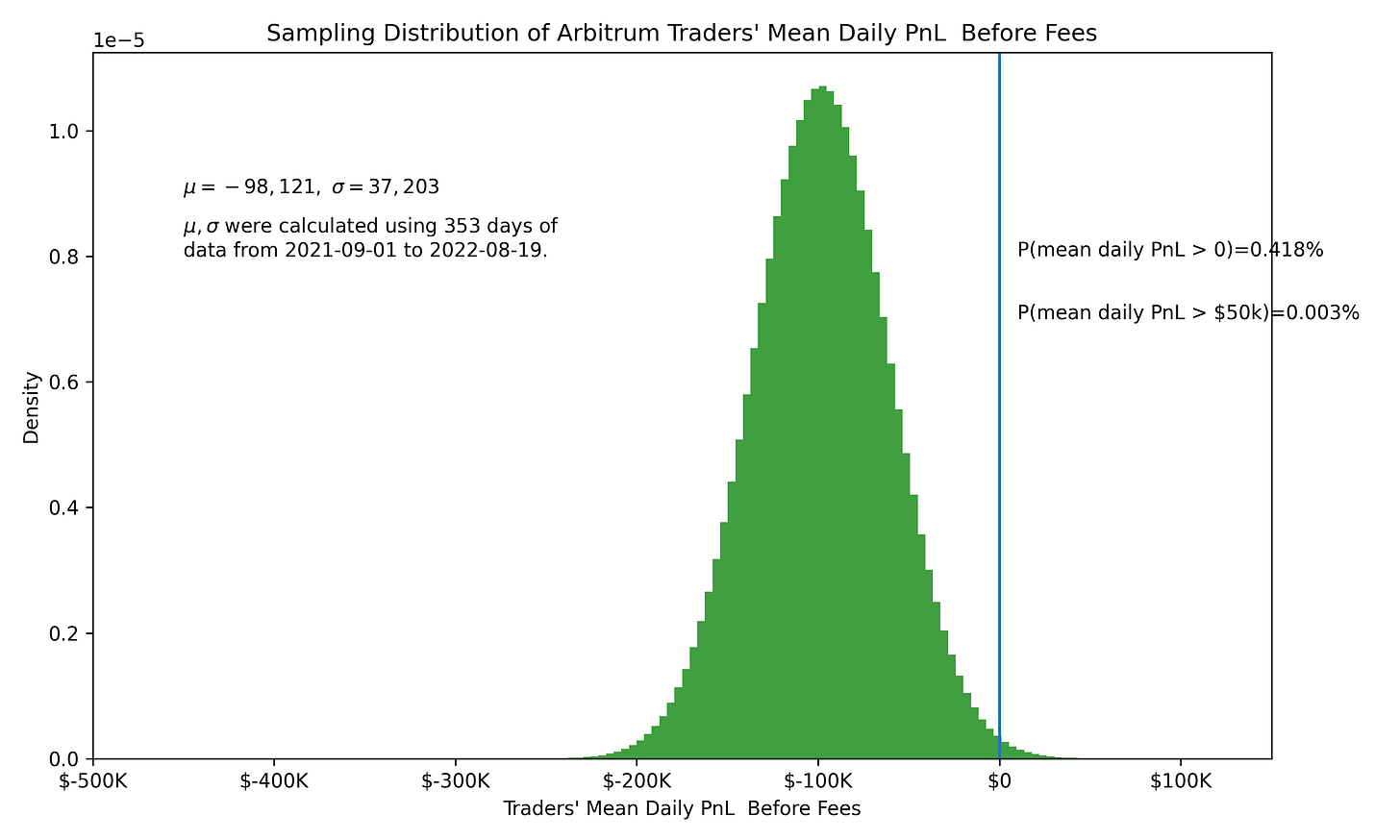

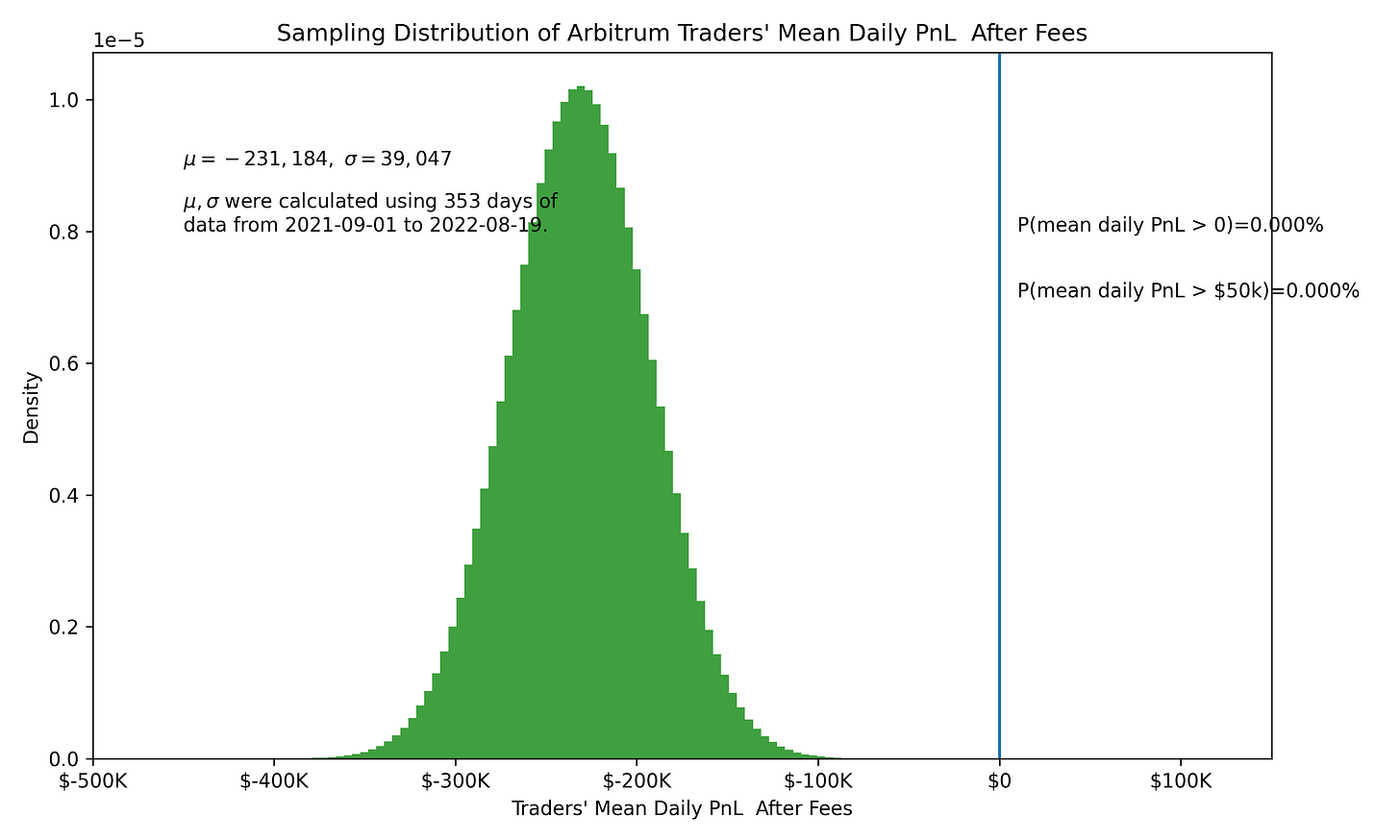

Arbitrum

Arbitrum GMX traders on average lost $98,121 per day before borrow and liquidation fees in the past 353 days, and $231,184 per day after fees.

Before accounting for borrow and liquidation fees, for every 1,000 simulations of possible futures, there are 4 of them where traders will on average make money. And for every 100,000 simulations, there are 3 of them where traders on average make more than $50K per day.

After accounting for borrow and liquidation fees, the chances for traders to make money collectively is close to zero.

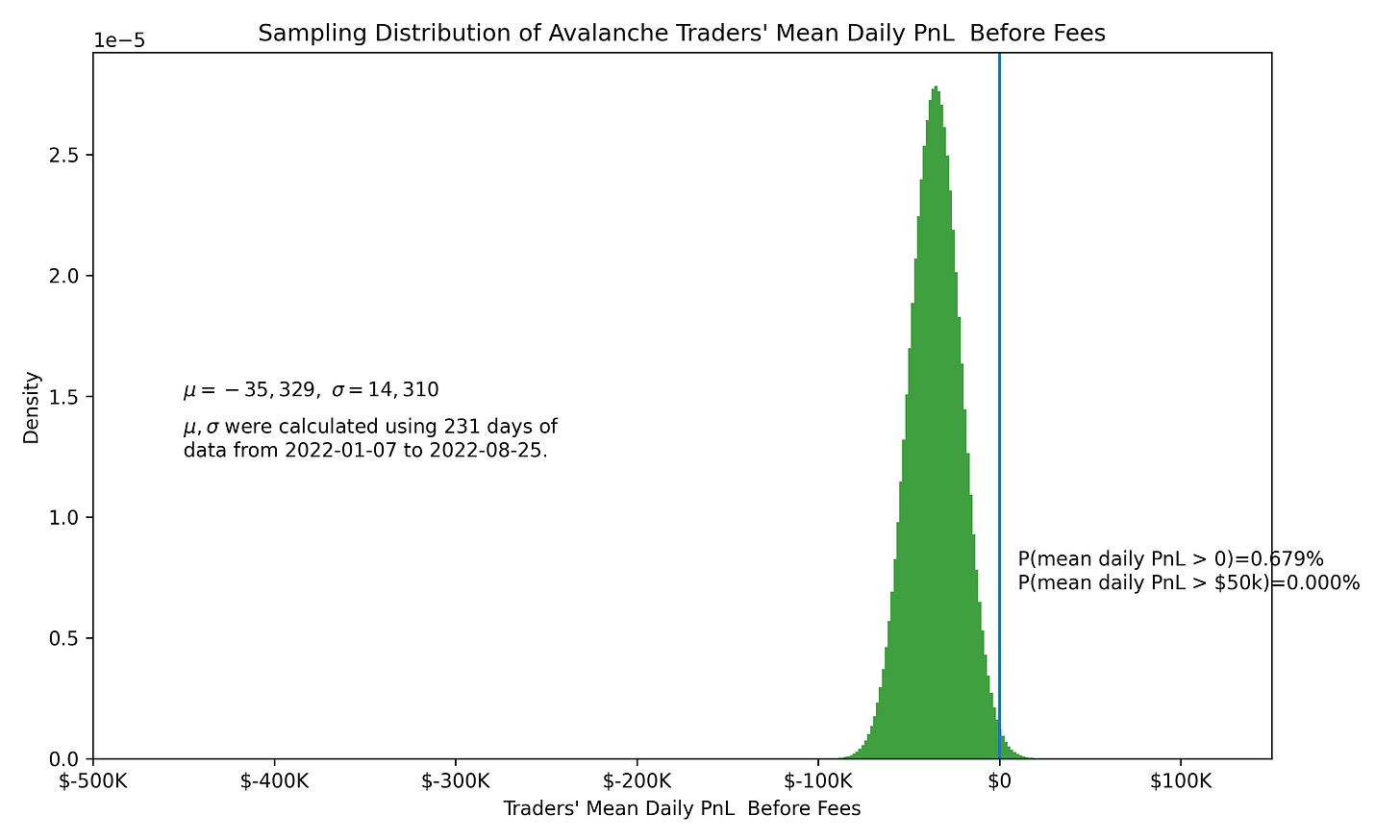

Avalanche

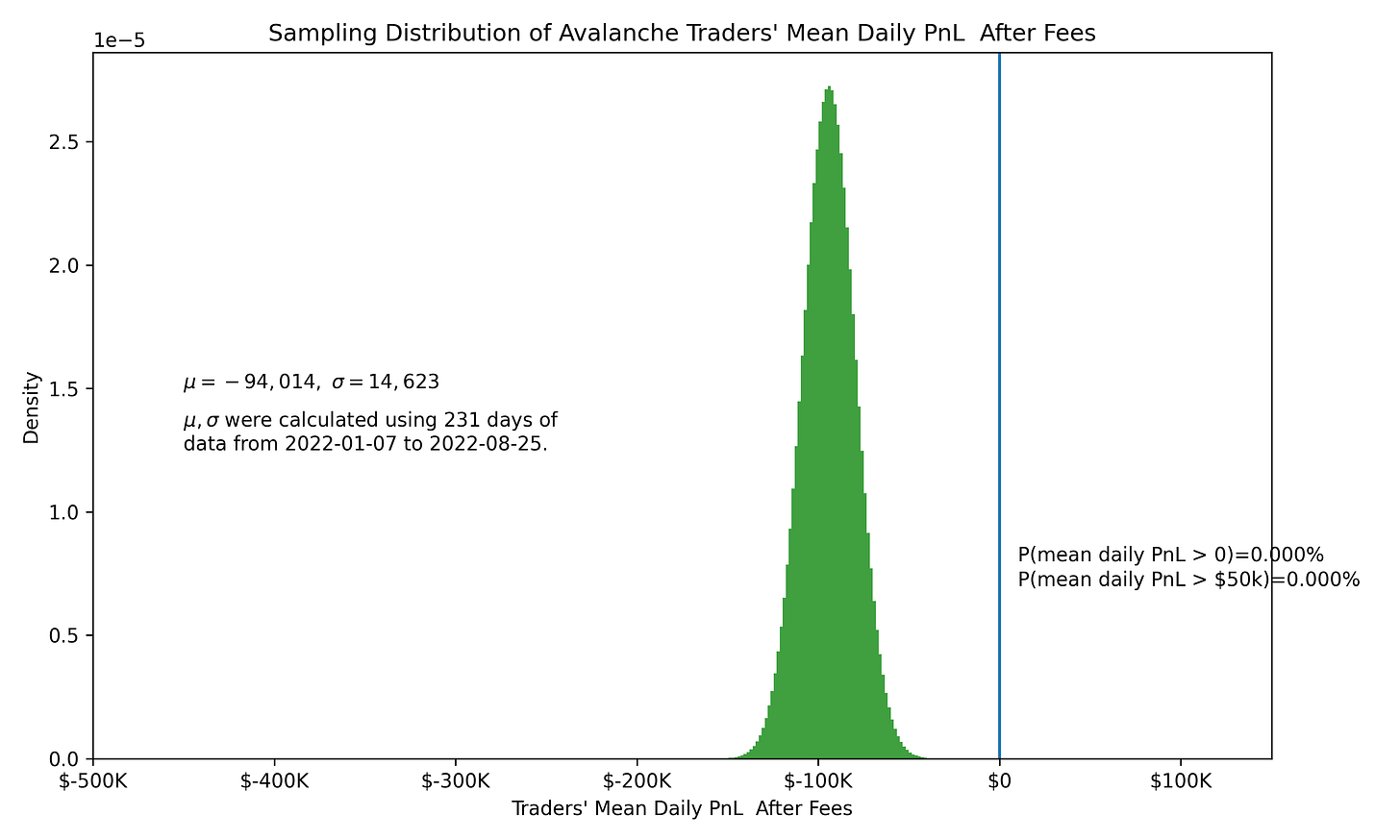

Arbitrum GMX traders on average lost $35,329 per day before borrow and liquidation fees in the past 231 days, and $94,014 per day after fees.

Before accounting for borrow and liquidation fees, for every 1,000 simulations of possible futures, there are ~7 of them where traders will on average make money. Yet the chances of traders on average making more than $50K per day is almost zero.

After accounting for borrow and liquidation fees, the chances for traders to make money collectively is close to zero.

Data & Code

Arbitrum Data (2021-09-01 ~ 2022-08-19) and Python Notebook

Avalanche Data (2022-01-07 ~ 2022-08-25) and Python Notebook

Referrals

This section contains affiliate links to crypto products. If you click on the link and use the product, I may receive a small commission at no cost to you. I only link to products I use myself.

Get 5% discount when trading on GMX.

Juno Finance offers free onramp to Arbitrum, Optimism and Solana, a high interest bearing checking account (currently at 5%), and a great loyalty program that gives ledger, gift cards, and 5% cash back for spending. You will get $10 and 500 JCOIN if you use my referral link to open an account and fund it with $50 worth crypto or more. Available to US persons and requires KYC.

If you enjoyed this article and would like to buy me a coffee, you can send ETH, WBTC, AVAX, BNB, USDC, USDT to 0x783c5546C863f65481BD05Fd0e3FD5f26724604E, or you can tip me sat. Thank you and have a great day!

According to KR from GMX’s team, the contracts read the current PnL of all outstanding traders and reflect it in the price to avoid massive movement of GLP price when positions close. So in my trade example, the PnL, leading up to -$5.88, was continuously baked in GLP’s price.