GLP Buy and Hold Returns

For Arbitrum, holders of the GLP token earn Escrowed GMX rewards and 70% of platform fees distributed in ETH. For Avalanche, holders of the GLP token earn Escrowed GMX rewards and 70% of platform fees distributed in AVAX. — GMX platform documentation

Previously, we analyzed GMX’s revenue growth and breakdown. Today we will investigate the returns for GLP holders. Conceptually, GLP returns come from three places: GLP price action, platform revenue (70%), and esGMX rewards. We’ll ignore esGMX rewards because they need to be vested to become GMX tokens first before they can be sold, and vesting takes a long time. Nonetheless, as we’ll see, even without esGMX rewards, historically, it was better to own GLP than BTC or ETH1.

In the following analysis, we’ll first look at GLP’s returns by price action alone, excluding the 70% revenue share. Then we’ll include the 70% revenue in the returns. Let’s dive in.

GLP - Arbitrum

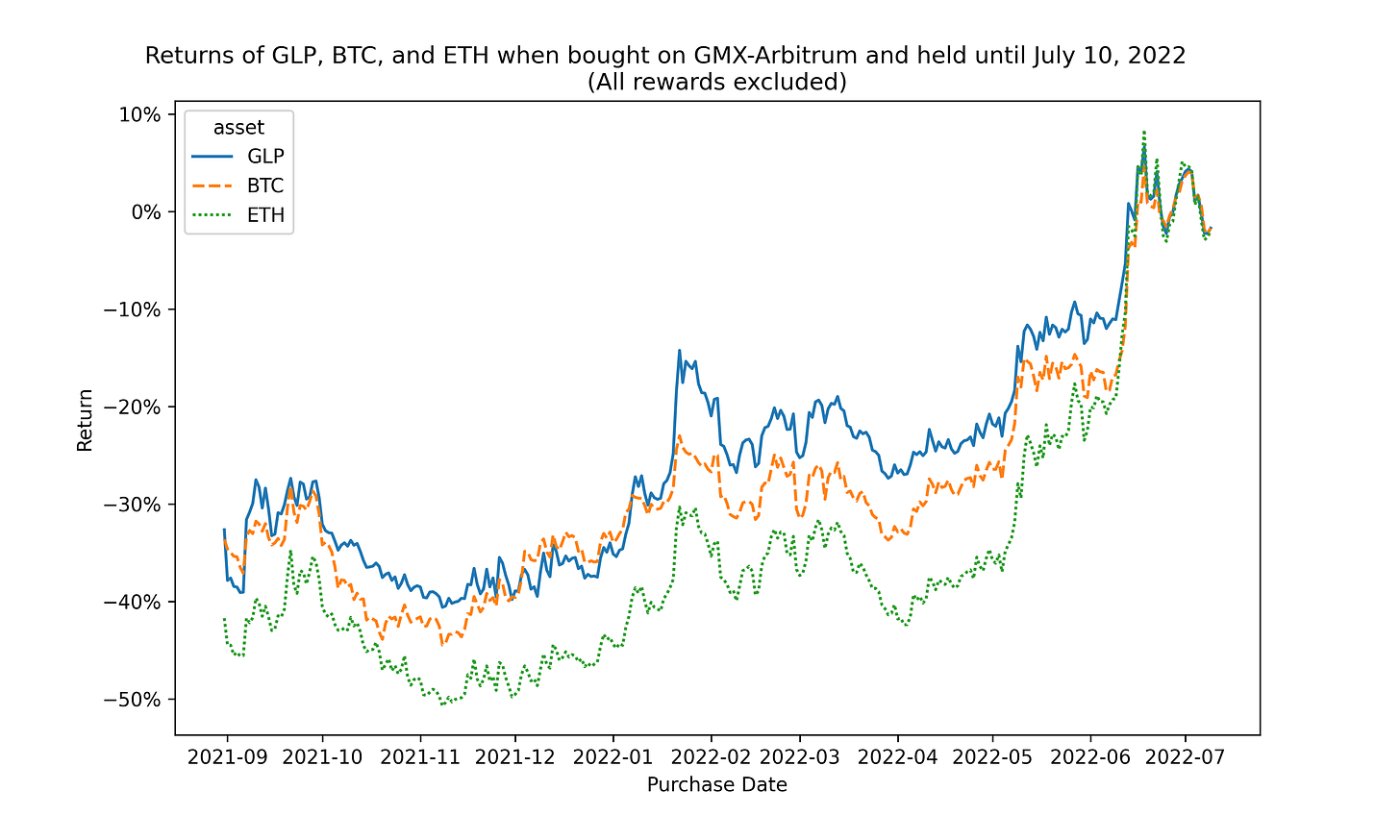

The following chart shows the buy-n-hold, reward-excluded returns of GLP on Arbitrum, compared with that of BTC and ETH, for each hypothetical purchase date. It answers this question, “If I bought GLP on Arbitrum on such and such date and held until today2, and if I discarded the yields earned for holding GLP, what would be my return? And how would it compare with holding BTC or ETH?”

We see the price action of GLP on Arbitrum alone resulted buy-hold returns on par with BTC or better, regardless of entry date. This is because ~50% of GLP on Arbitrum is held in stablecoins and ~50% in BTC and ETH. It's also because traders' PnL gets factored into GLP price and traders have been net-losing.

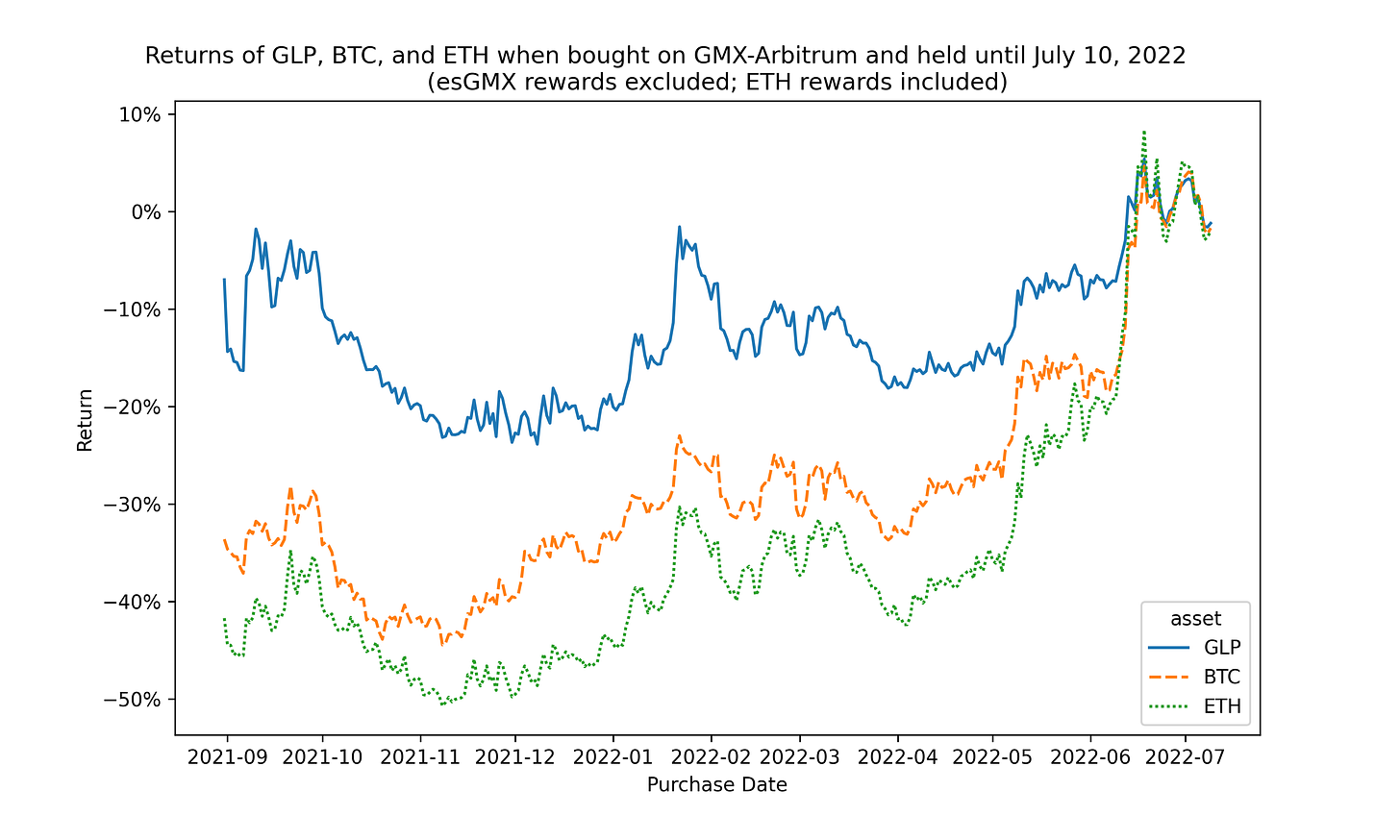

Next, let’s look at returns after including the 70% platform revenue distributed in ETH to GLP holders.

We see that after including those ETH rewards, GLP on Arbitrum outperformed BTC and ETH by big margins most of the time except in the recent month. Hats off to those ETH rewards!

GLP - Avalanche

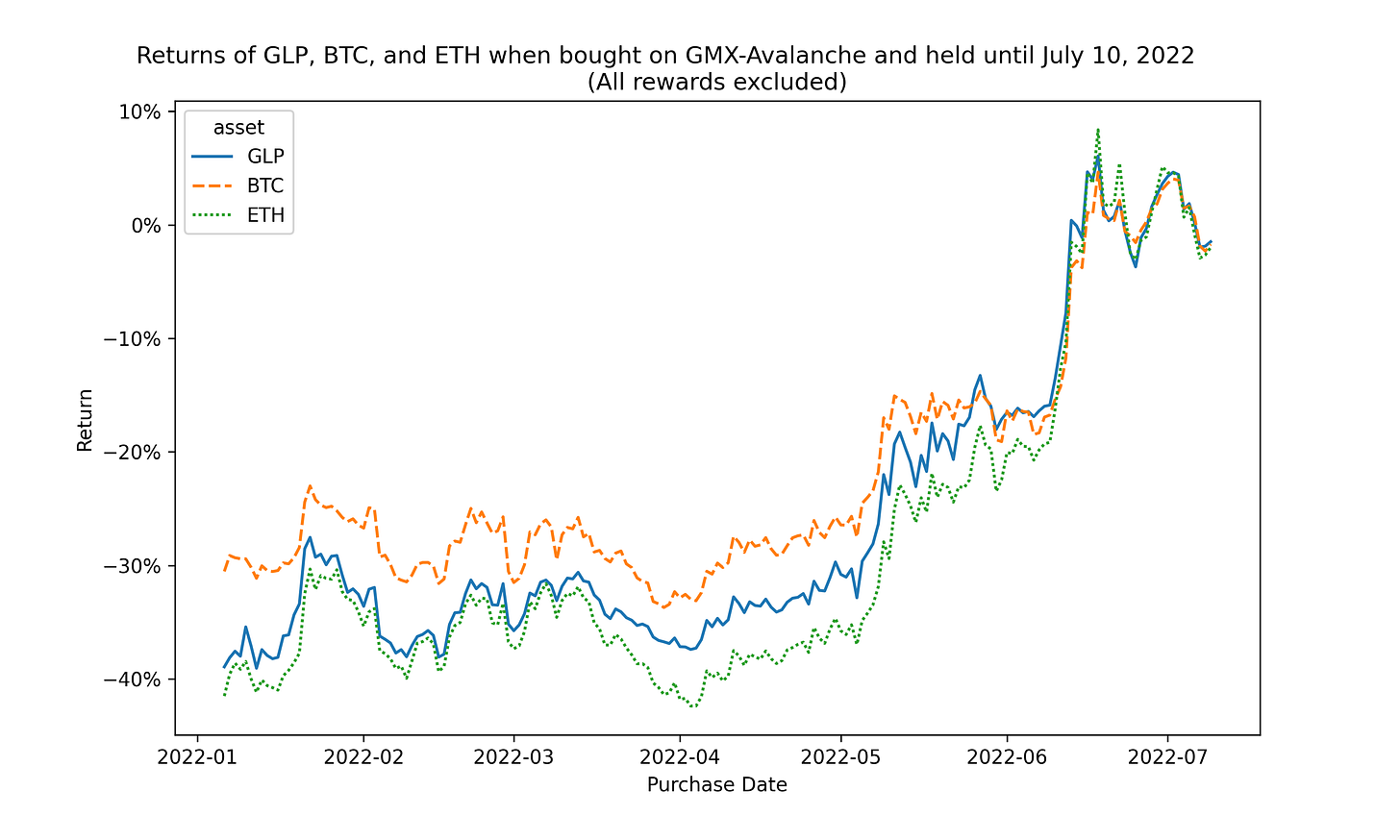

Let’s now turn to GLP on Avalanche, which started four months later in the beginning of January 2022. The following chart shows the buy-n-hold, reward-excluded returns of GLP on Avalanche, compared with that of BTC and ETH, for each hypothetical purchase date.

We see that when yields are excluded, the buy-hold returns of GLP on Avalanche get sandwiched between those of BTC and ETH. This is because ~13% of GLP on Avalanche is held in AVAX, and AVAX price drops more than BTC or ETH prices do when market crashes. Also since traders' PnL gets factored into GLP price, the above chart probably suggests that traders didn’t net-lose as often or as badly as on Arbitrum. What happens if we include in the returns the 70% revenue distributed in AVAX to GLP holders? That’s what the next chart shows.

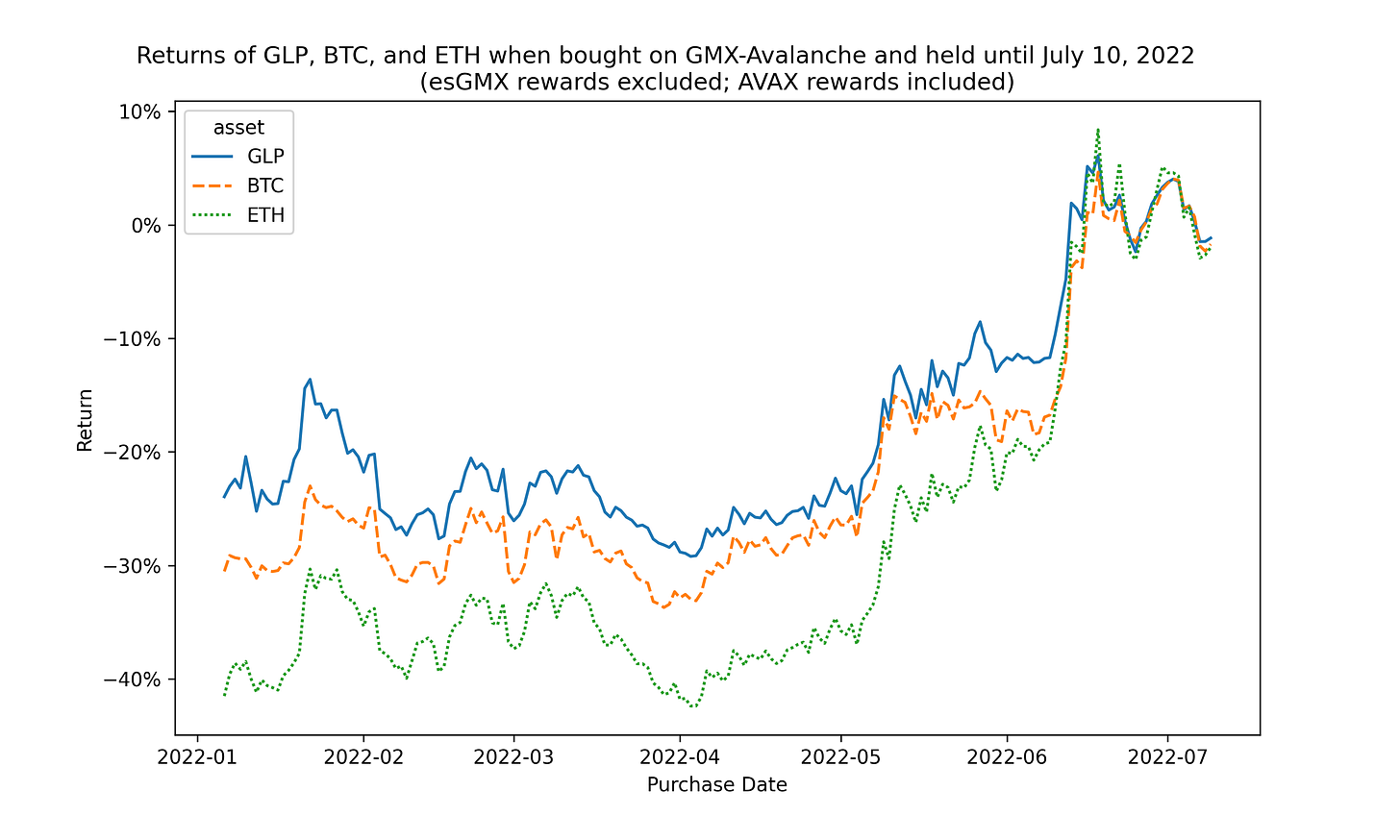

We see that after including those AVAX rewards, GLP on Avalanche outperformed BTC and ETH, although not as dramatically as on Arbitrum, most of the time except in the recent month. Hats off to those AVAX rewards!

Data & Code

Arbitrum Data (2021-08-31 ~ 2022-07-10) and Python Notebook

Avalanche Data (2022-01-06 ~ 2022-07-10) and Python Notebook

Referrals

This section contains affiliate links to crypto products. If you click on the link and use the product, I may receive a small commission at no cost to you. I only link to products I use myself.

Get 5% discount when trading on GMX.

Juno Finance offers free onramp to Arbitrum, Optimism and Solana, a high interest bearing checking account (currently at 5%), and a great loyalty program that gives ledger, gift cards, and 5% cash back for spending. You will get $10 and 500 JCOIN if you use my referral link to open an account and fund it with $50 worth crypto or more. Available to US persons and requires KYC.

If you enjoyed this article and would like to buy me a coffee, you can send ETH, WBTC, AVAX, BNB, USDC, USDT to 0x783c5546C863f65481BD05Fd0e3FD5f26724604E, or you can tip me sat. Thank you and have a great day!

GLP came into existence on August 31, 2021 on Arbitrum. Between September and December 2021, the crypto market was pretty bullish. But It has become more and more bearish since January 2022 and eventually crashed in May and June 2022. At the time of this writing, the market seems to have bottomed, although it is still rife with bad news.

Today was July 10, 2022 at the time of the writing.